Deciphering The Technology Behind Cryptocurrencies

By Pavan Seepana

Introduction

A cryptocurrency is a digital currency that uses cryptographic systems to make it near-impossible to counterfeit or double spend.

The word “Crypto” refers to the range of encryption algorithms and cryptographic techniques that protect data, using methods such as elliptical curve encryption, public-private key pairing, and hashing functions.

Most cryptocurrencies are blockchain technology–based decentralized networks – i.e. distributed ledgers carried out by a disparate network of computers. One of the most distinguishing and defining features of cryptocurrencies is that they are not issued by any government or central authorities. This makes them, in theory, immune to government manipulation or interference.

Fiat currencies or traditional money get their authority as means of transaction from the monetary authorities that release them. But cryptocurrencies are not backstopped by any public or private entities. This has been one of the major reasons why it has faced challenges in terms of claiming a legal status in different financial jurisdictions around the world, which effects the use of cryptocurrencies in everyday trading and transactions.

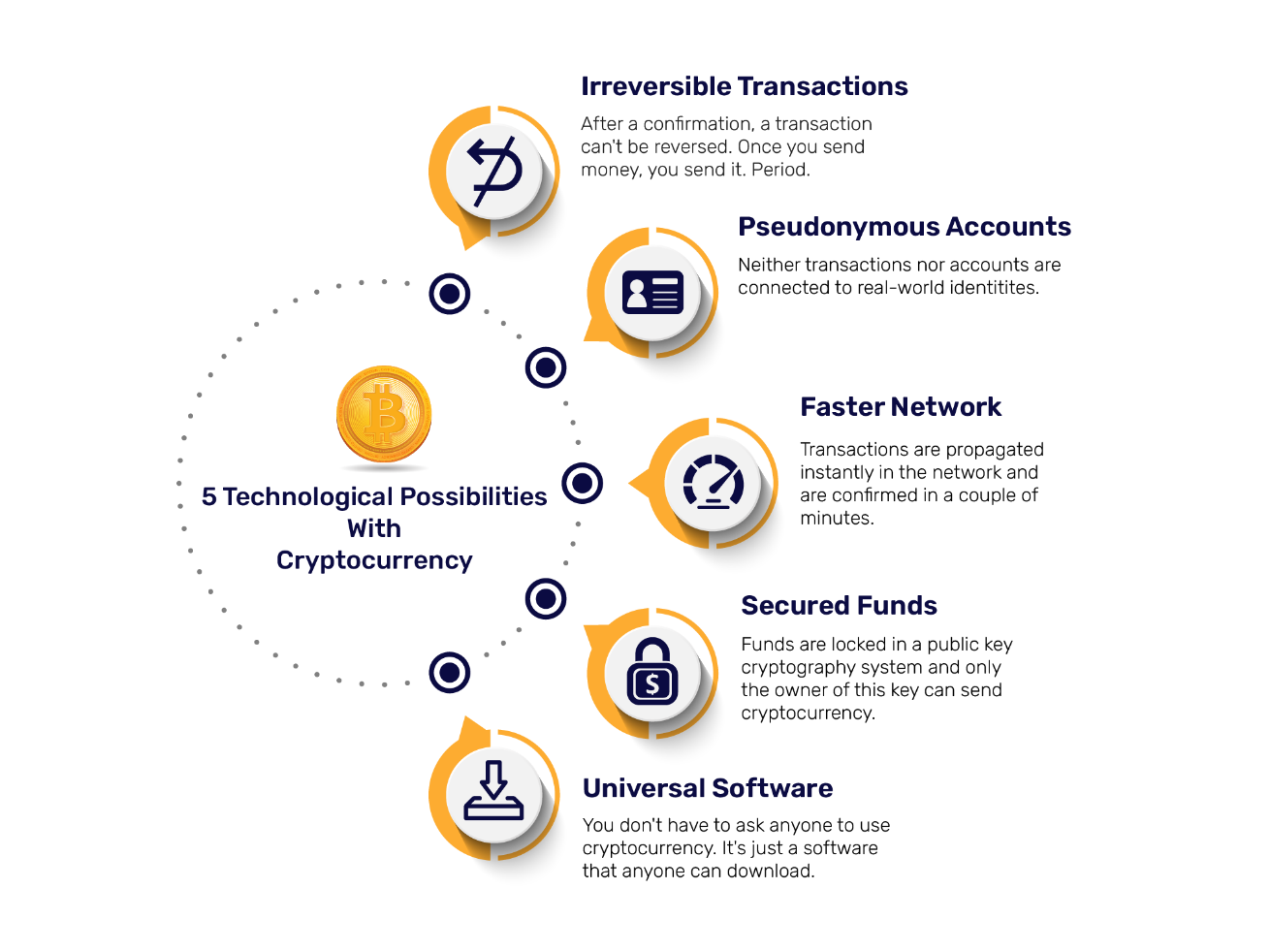

5 technological possibilities with Cryptocurrency

Cryptocurrency: Highs and Lows

The market capitalization of crypto assets has surged despite large bouts of price volatility

In early 2021, the market capitalization almost tripled to an all-time high of $2.5 trillion, followed by a 40% fall in May. This was caused mainly by the rising concerns from traditional holders and escalating global regulatory scrutiny. Notwithstanding, the market capitalization of cryptocurrencies is on a continued rise.

A key factor for this is increasing investor interest in newer technologies, such as:

-

1. Stable coins:

With growth to above $120 million last year, stable coins have seen 4x growth and the highest trading volumes as compared to all other cryptocurrencies. One of the primary reasons for this could be their high usability when it comes to spotting settlement and derivatives trades on exchanges.

-

2. Ethereum and blockchain-based ‘smart contract’:

Although Bitcoin remains by far more popular cryptocurrency, its market share has dropped significantly in 2021, from more than 70% to less than 45%. Newest blockchains that use smart contracts have garnered interest in the market, with the aim of addressing the challenges of former blockchains by incorporating features that ensure scalability, interoperability, and sustainability. The most well-known is Ether, which in 2021 overtaken Bitcoin in terms of the trading volume.

-

3. Decentralized finance (DeFi):

DeFi grew from $15 billion at the end of 2020 by about $110 billion in September 2021, given the rapid growth of decentralized exchanges that allow traders to exchange crypto assets without an intermediary and credit platforms that connect borrowers and lenders without the need for a credit risk assessment of the customer.

International Legal Regulation Landscape for Cryptocurrency

Around the world, governments stand divided on how they want to regulate this emerging class of asset.

1. Highly Regulated or Banned

The People’s Bank of China – China’s central bank – has completely banned cryptocurrency transactions in the country. In Russia, cryptocurrency is not really outlawed, but it has been subjected to some strong regulations such as the Digital Financial Assets and Digital Currencies Law which disallows its use for exchange of goods and services. The government of India, wary of using external crypto currency as medium of transaction, is planning to create its own cryptocurrency regulated by RBI

2. Minimal Regulations

US, although, has not legalized the use of cryptocurrencies as legal tender but allows trading practices with minimal regulations. Also, since legally cryptocurrencies can be used for retail transactions American taxpayers are obligated to report their crypto transactions to be taxed as per the IRS guidelines.

Cryptocurrency is unregulated in the United Kingdom.

Within the European Union, it is legal to transact and trade in transactions and trading but are subject to respective state rules. Additionally, the European Court of Justice (ECJ) which is the highest court in the EU, has ruled that digital currencies can be deemed as a supply of services.

3. Fully Legalized

In September 2021, El Salvador became the first country to accept bitcoin as a legal tender in their country.

Tech Behind Crypto

Blockchain is the underlying technology driving most cryptocurrencies, but its unique way of securely recording and transferring information has much broader applications outside of cryptocurrency.

If you want to use blockchain in your business, you should hire a blockchain service provider. These companies can assist you in implementing and managing blockchain in your company. It’s a straightforward technique to implement. Even though Ethereum is one of the most prominent and widely used blockchain platforms in the world, the most cost-effective approach to get started with blockchain is to use blockchain as a service from AWS, Azure, or Oracle.

Some of the popular blockchain platforms:

-

Ethereum:

Basically, it is used to develop innovative contracts and is currently used by many organizations to determine their potential business growth rates.

-

Quorum:

Many companies have adopted Quorum in their blockchain implementation because it allows highly secure and private transactions without the risk of data tampering.

-

Hyperledger Fabric:

This is used to create private blockchain apps for businesses.

-

Stellar:

Basically, Stellar as a blockchain platform is used to develop blockchain applications for companies and organizations.

-

Corda:

An expert in this blockchain platform which allows direct smart contract transactions, as well as leveraging the platform to eliminate all costly contingencies in your business contracts.

-

Open chain & Multichain:

The primary objective of these blockchain platforms is to leverage blockchain technology to maximize human resource management functions.

Cryptoization: International Adoption of CryptoCurrency

Cryptocurrency adoption has outperformed in some emerging markets and developing economies than in most advanced economies.

According to a recent survey by Statista, the top five crypto using or owning countries in 2020 were emerging market and developing economies, where the slowest adopters have been advanced economies. Even if you are not sure about including cryptocurrency in your business strategy, the technology behind it, like blockchain, have varied use cases to improve security, risk management and more for businesses across industries.

Talk to our blockchain experts to learn more.

“

Paper money is going away.

– Elon Musk

Published Date: 21 April, 2022